- Accueil

- portfolio 900

- Portfolio trading breaks into new markets - The DESK - The leading source of information for bond traders

Portfolio trading breaks into new markets - The DESK - The leading source of information for bond traders

4.9 (193) · € 39.50 · En Stock

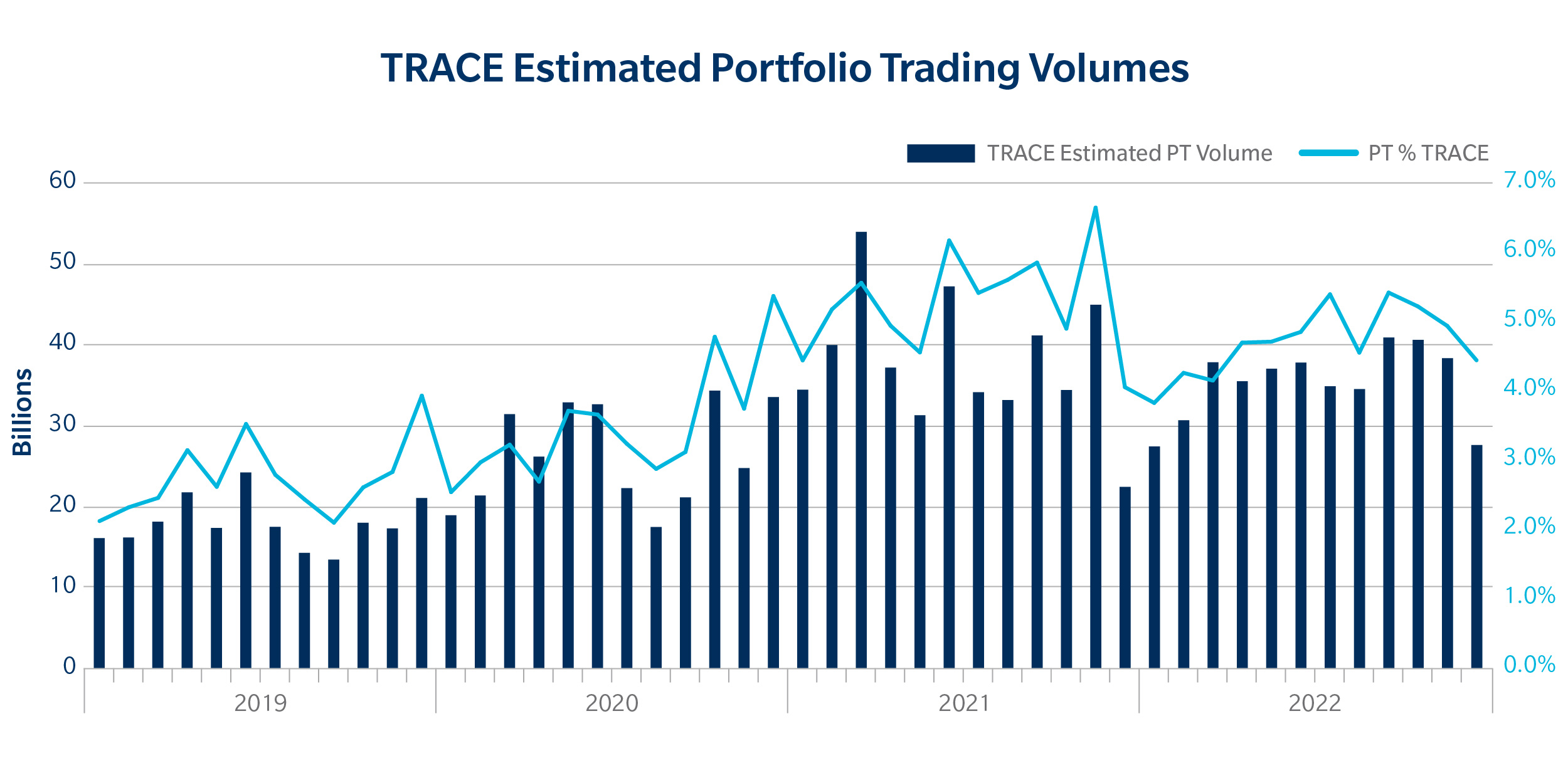

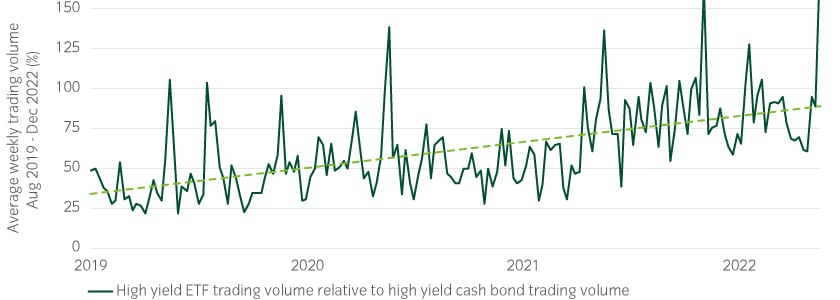

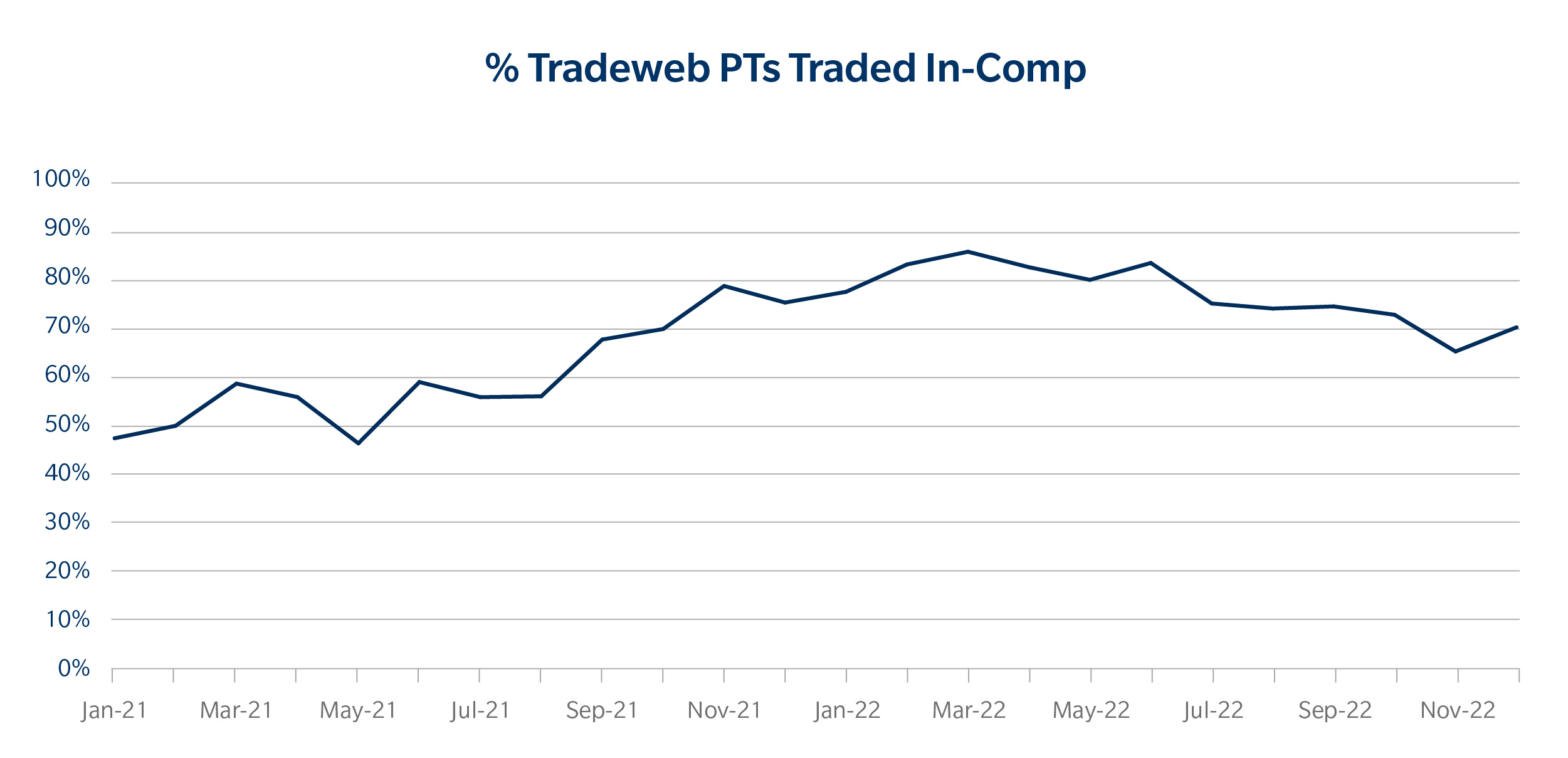

Emerging markets are adopting PT to add efficiency to liquidity sourcing, writes Matt Walters of MarketAxess. Portfolio trading has seen a lot of success and now it is expanding into emerging markets as part of its continued growth. Traders across the buy- and sell-side are finding new applications and situations in which it can be highly effective. TRACE data in the US indicates that portfolio trading volumes increased by US$100 billion in 2022 versus 2021. That was led by taking activity from voice trading. The growth of our own Portfolio Trading volume has also been rapid - in 2022 we

You Can't Kill the Bloomberg Terminal. But If You Were Going to

Mind Over Markets: Power Trading with Market Generated

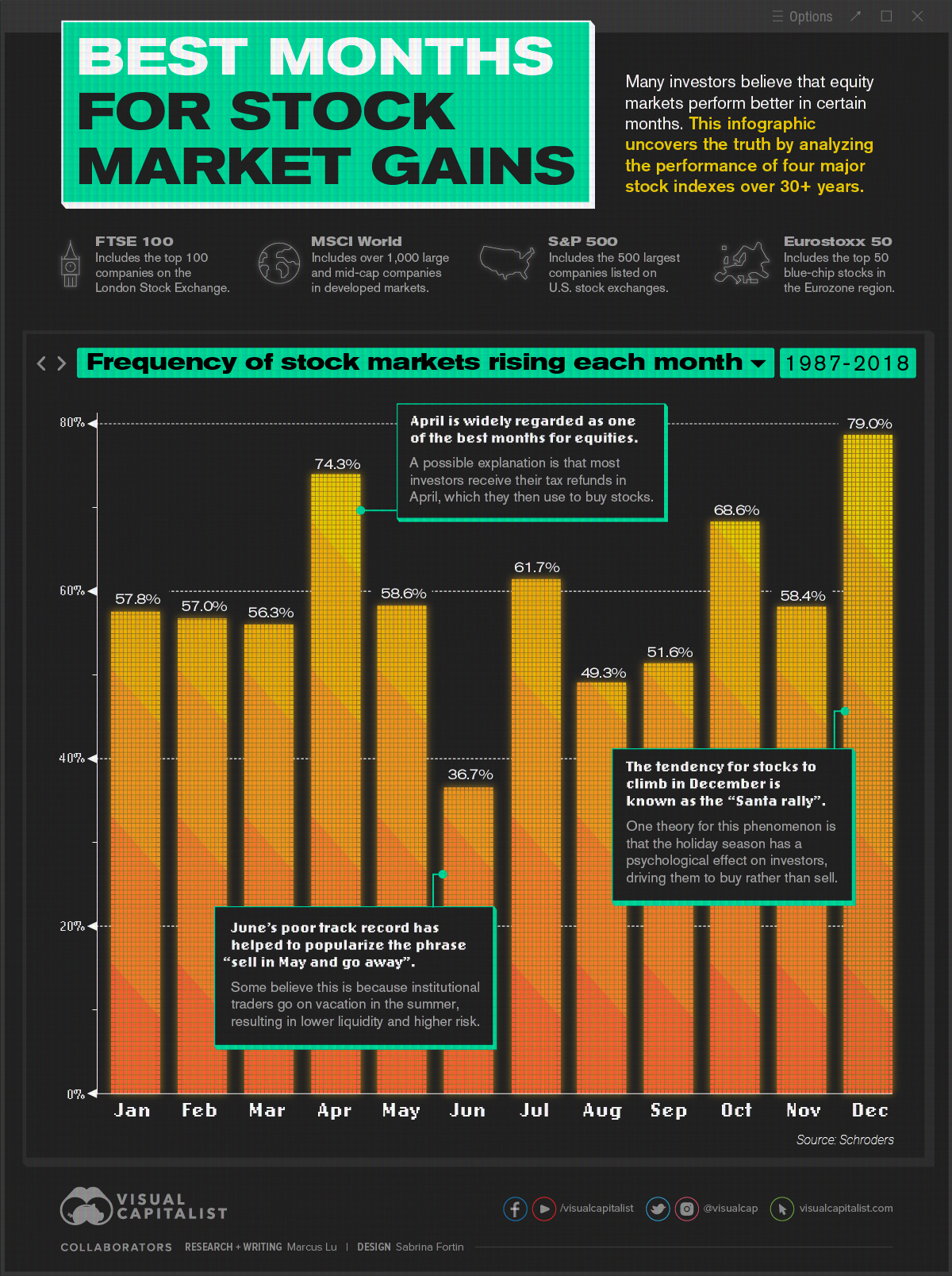

The Best Months for Stock Market Gains

Portfolio Trading Trends: A Breakdown of 2022

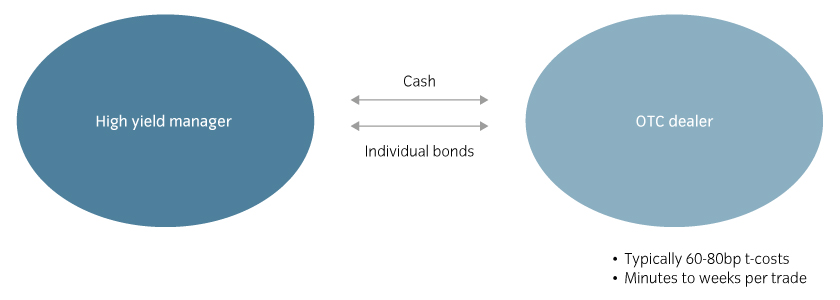

Credit Insights: Credit portfolio trading explained

Portfolio trading just keeps growing - The DESK - The leading

Credit Insights: Credit portfolio trading explained

:max_bytes(150000):strip_icc()/blocktrade.asp-final-e6b9cd66dd8e42168655c1bc5b16b458.png)

Block Trade: Definition, How It Works, and Example

Foreign exchange market - Wikipedia

Portfolio Trading Trends: A Breakdown of 2022