- Accueil

- 9780529100559

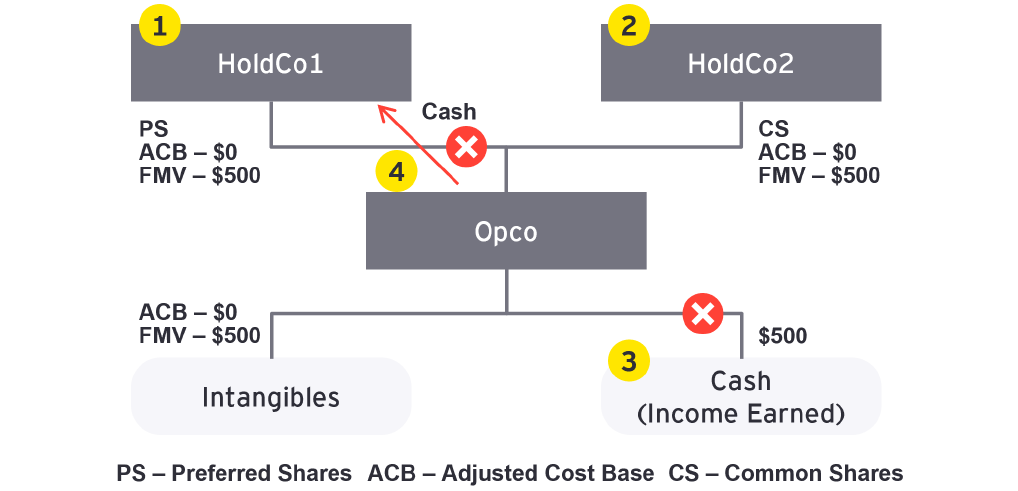

- Understanding Section 55 and Butterfly Reorganizations, 3rd Edition - Canada - Taxation

Understanding Section 55 and Butterfly Reorganizations, 3rd Edition - Canada - Taxation

4.7 (444) · € 35.50 · En Stock

AU Mission Washington, DC - Invest in Africa 2019, Vol. 2 by AMIP News - Issuu

Taxation of Corporate Reorganizations, 3rd Edition: Paul Lamarre, Colin Campbell, B.A., M.Sc., Ph.D., LL.B., Raj Juneja: 9780779889440: Books

ED KROFT, Q.C. - Tax Executives Institute, Inc.

Sample Chapter Tax and Family Business Succession Planning, - PDF Free Download

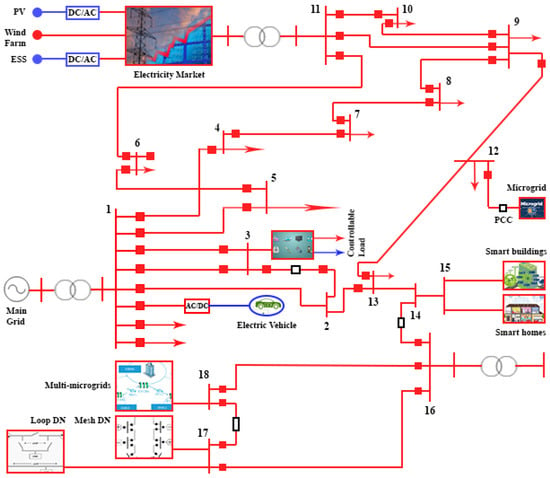

Sustainability, Free Full-Text

EY Tax Alert 2023 no 49 - CRA updates its views on safe income

Blog — Burgess Kilpatrick Chartered Professional Accountants in Vancouver, BC

WWL Arbitration 2022 by lbresearch - Issuu

In Print: The Purpose of Subsection 55(2)

PDF) Ownership of data and the numerus clausus of legal objects

Sustainability August-2 2023 - Browse Articles

The Blunt Bean Counter: Corporate Divorces and Butterflies

Butterfly Reorganization Leading to Third-Party Tax Liability

Understanding the LIBOR scandal: the historical, the ethical, and the technological

2014 CPA Canada In-Depth Tax Course Student Handbook by Chris Cramer - Issuu